<1 month

Time to issue first invoice with Sequence15%

cost savings from operations, revenue slippage and billing errors250% capacity expansion

Ivy can now accurately invoice 500+ usage based customers with 1 operatorSchedule your demo and get started in hours.

Sequence was the only solution which could provide the sophisticated quote to cash solution for our consumption-based pricing and custom deal terms. We were underwhelmed by existing tools in the space and needed a platform which was more purpose-built for Fintech pricing models.

Maria, Operations lead at Ivy

Ivy has launched an innovative new payment rail, leveraging instant bank payments and passing the benefits from the arbitrage back to merchant and consumer. After a breakthrough $20m Series A in August 2023, Ivy faced a critical challenge: they needed a billing solution that could keep up with their rapid growth and unique B2B fintech requirements.

Sequence provides a streamlined, easy-to-use quote to revenue platform for Ivy’s fast-growing Fintech customer base.

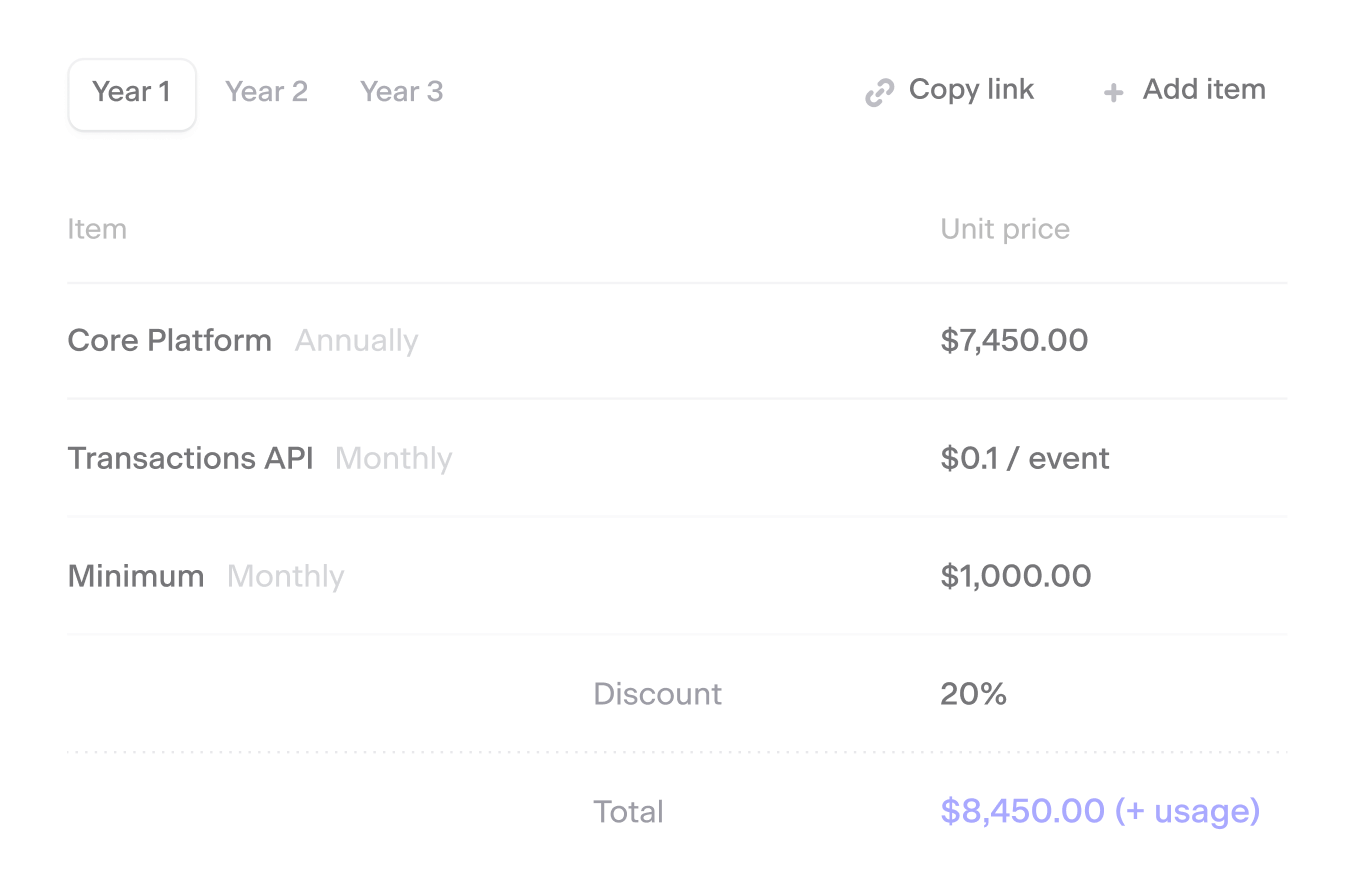

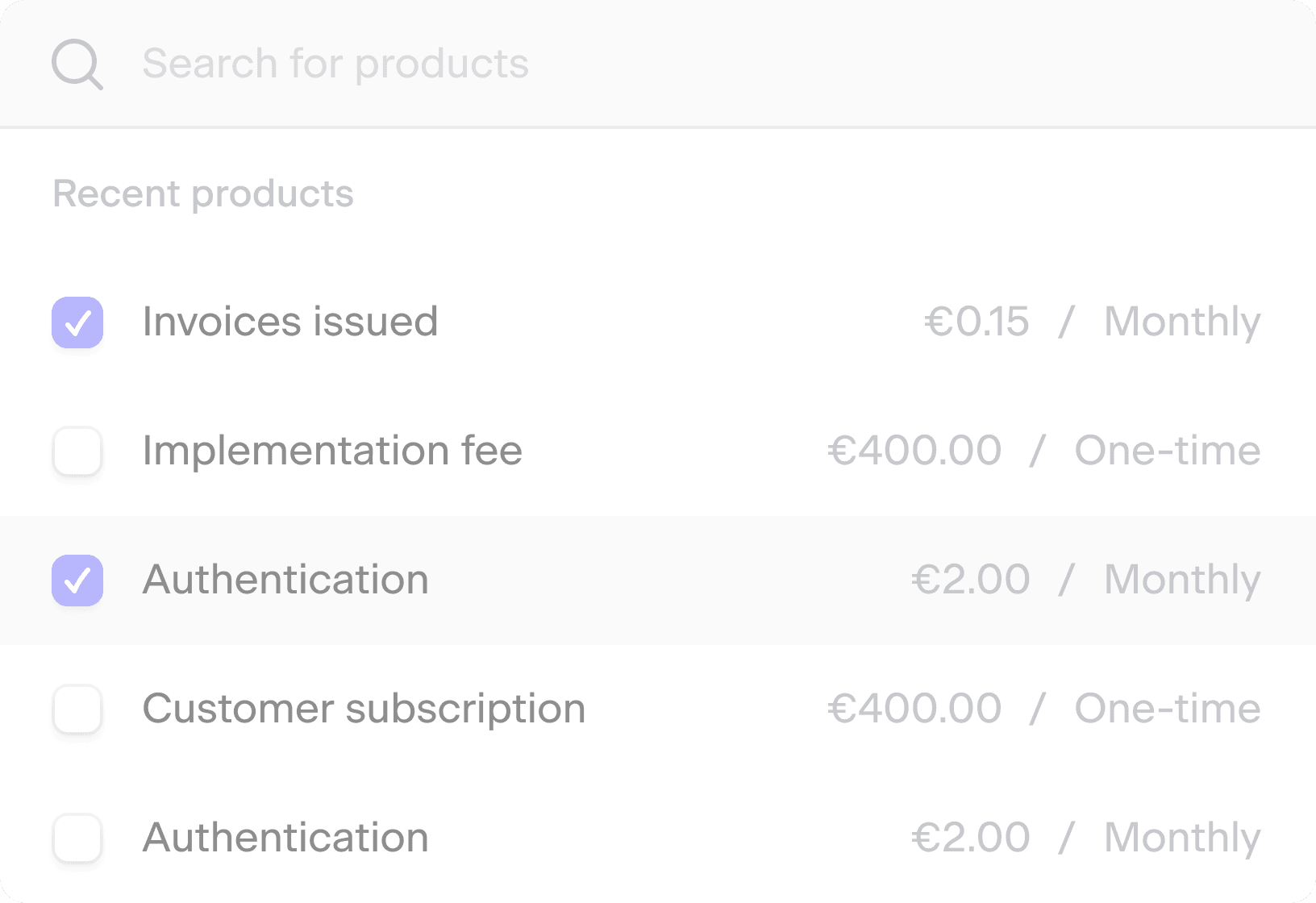

After evaluating multiple tools in the market, Ivy chose Sequence to scale their revenue collection process. Ivy charges customers in real-time, and needed a pricing and billing engine that could handle their custom, transaction-based deal terms (fixed fee + % fee per transaction) while providing accurate end of month billing statements for customers. With only 1 billing operator and a rapid expansion in billing volume, speed of implementation and product usability were key differentiators for their CTO and Finance Lead who completed the evaluation.

The Challenge

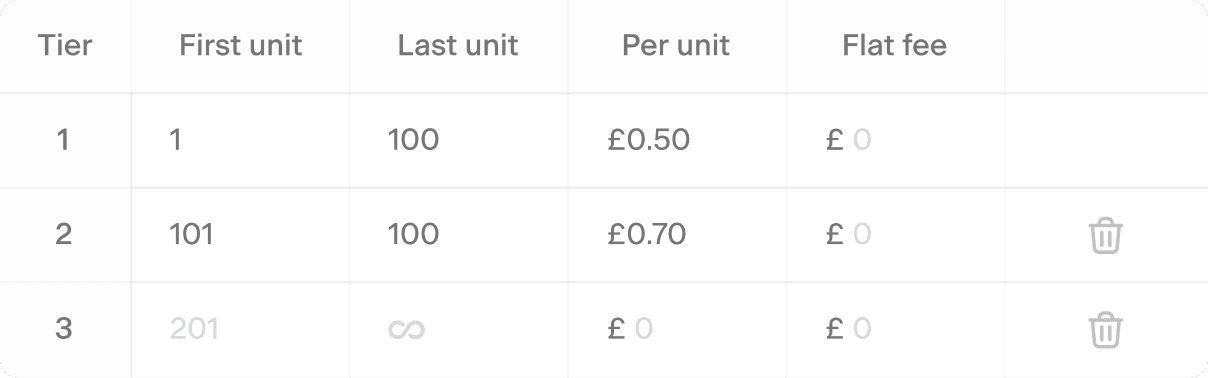

Pricing flexibility: Transaction charges (% + €)

Ivy charges both a % based fee and fixed fee per transaction. These fees stay constant for the majority of their customers, but it’s important that there is scope for customisation (rate adjustments, price ramps, custom discounts) where needed. By leveraging the Sequence product catalogue to create their core group of usage-based products, Ivy could quickly apply their pricing logic across their customer base.

Real-time billing

Ivy’s customers pay these fees at the point of transaction, meaning they need a billing engine which can provide both the flexibility to combine % and fixed fees, but also capable of applying these charges in real time, aka ‘instant charges’. On top of this, the billing platform would need to provide accurate end of month statements for all charges incurred by each customer, to make it easy for end customers to reconcile their monthly usage and charges.

Implementation speed & resource constraints

Given their pace of growth, Ivy were growing beyond headcount capacity, and needed a tool which could be rolled out in weeks, rather than the 6+ months typically observed for most billing solutions. With Sequence, they were able to go from 0 to production in 4 weeks thanks to the seamless UI and ease of getting started in Sequence with just a simple usage data export.

The Solution

Flexible configuration of transaction-based pricing (% + €)

Ivy charges both a % based fee and fixed fee per transaction. These fees stay constant for the majority of their customers, but it’s important that there is scope for customisation (rate adjustments, price ramps, custom discounts) where needed. Sequence's product catalog allowed Ivy to swiftly configure and apply this pricing logic across all customers, maintaining consistency while offering customization for specific needs.

Addressing Revenue Leakage and Billing Errors

To tackle the challenge of revenue leakage and billing errors, Sequence provided a comprehensive platform that enabled accurate tracking and consolidation of complex pricing agreements. This allowed Ivy to safeguard against revenue loss and ensure billing accuracy for its diverse customer contracts.

Designed for modern teams

With the billing system's management resting on a single operator amid Ivy's hypergrowth, the simplicity and efficiency of Sequence's dashboard were vital. Sequence offered a user-friendly interface and a setup process that facilitated a smooth transition to live operations within weeks, directly addressing Ivy's need for speed and efficiency.

Sequence Customers

Other companies using Sequence

See how forward-thinking companies use Sequence to reach their business goals.

See all customer stories