<40 days

Successfully onboarded hundreds of customers in under 40 days8 hours saved

Bridge reduced time spent on billing runs from 12 hours to 4 hours monthly100%

Fully accurate invoicing for hundreds of bespoke, usage based contractsSchedule your demo and get started in hours.

Bridge has a complex pricing model with a number of usage-based products that need customization. We were able to onboard onto Sequence in 40 days and start using them to bill customers, saving us a significant amount of time.

Max Cluss, Business Operations @ Bridge

Bridge is a stablecoin platform that simplifes global money movement and solves financial problems for companies and teams. Backed by Sequoia and Index ventures, Bridge is led by a team of operators from companies like Stripe, Uber, Coinbase, and Square.

Bridge chose Sequence to build a scalable accounts receivable process that supports their growing customer base with custom, usage-based contracts

Bridge’s impressive growth trajectory (having recently scaled their payments volume from $1m to over $600m in the last 18 months) made it clear that their manual accounts receivable process was no longer sustainable. Relying on Excel for manual billing calculations and then transferring data into QuickBooks wouldn’t scale with Bridge’s high volume of bespoke, usage-based contracts. To address this, Bridge decided to look for an accounts receivable platform with a highly flexible billing engine that could support both usage-based pricing and custom deal terms. After evaluating the market, they concluded that Sequence was best placed to automate their revenue collection workflow.

The Challenge

When companies go through hyper growth, it's common for billing and invoicing processes to break. Bridge's Finance team urgently needed to scale accounts receivables and usage-based billing to support their fast growing customer base. Their key criteria for their evaluation included a highly flexible billing model, a quick onboarding period and an intuitive UI that could be managed by a single, non-technical operator.

Retain flexible pricing to power complex, sales-led contracts

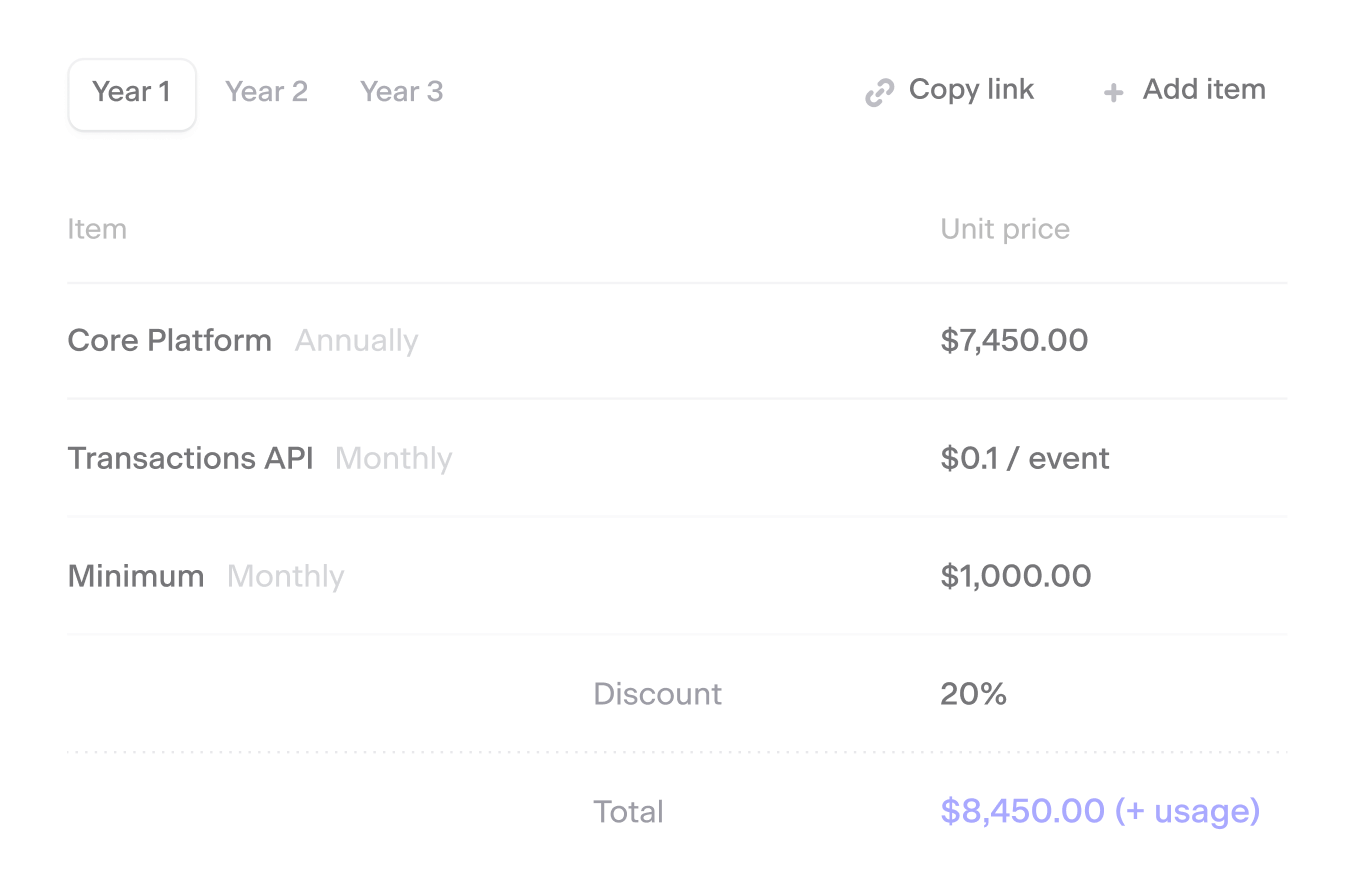

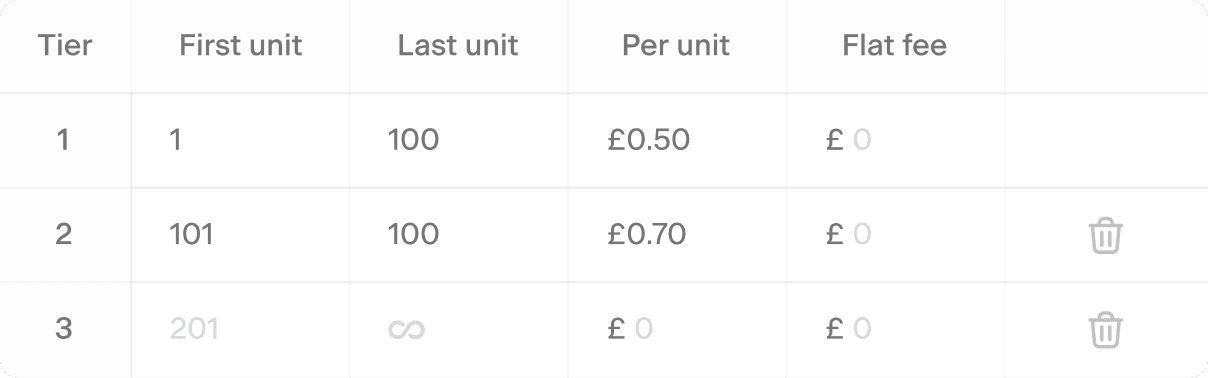

Bridge’s highly flexible, sales-led contracts include a range of pricing terms; usage-based products, minimum commitments, grace periods, custom discounts and multi-year phases / price cliffs. Bespoke, usage-based pricing terms have been essential for Bridge's sales team to win large contracts. As a result, Bridge were looking for a billing system that can support these nuanced contract terms and ensure that their sales team could continue to retain the flexibility needed to price deals in a way that is best for both the customers and Bridge’s internal growth goals.

Eliminate revenue leakage with accurate billing

Bridge's Excel process led to error prone billing calculations reliant on a single operator who had custom built formulae for each customer, resulting in an ongoing risk of invoicing mistakes, revenue leakage and customer complaints due to billing error. Bridge needed a more scalable solution that could accurately invoice for a rapidly expanding customer base.

Scale financial operations without growing headcount

Given their rapid customer growth, Bridge’s finance team quickly faced capacity constraints. Their billing evaluation placed a strong emphasis on a solution that could be implemented quickly without requiring a multi-month implementation across their finance and engineering team.

The Solution

A billing engine that supports any pricing model

Bridge continues to offer complex, sales-led contracts that promote the use of their usage-based products, charging either per unit (e.g. wire/ACH or active account) or by percentage (based on total transaction volume). By implementing minimum fees, they ensure consistent revenue across these offerings, a common practice among usage-based companies. With Sequence’s billing engine, Bridge's sales team can configure pricing terms with unlimited flexibility, without breaking the accounts receivable workflow downstream.

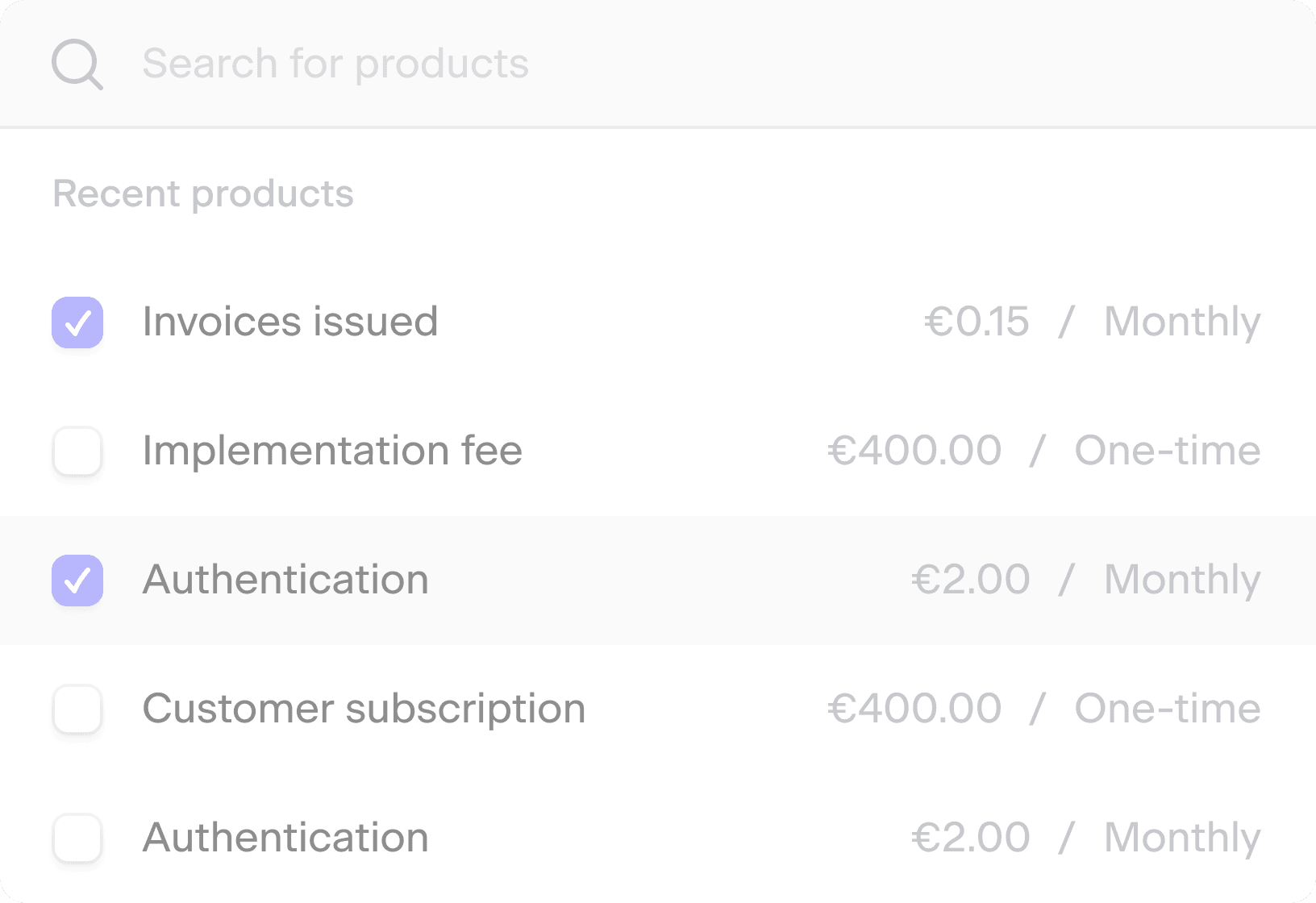

Accurate invoicing for hundreds of complex, usage-based contracts

Bridge’s high volume of usage data and bespoke usage-based contracts made invoicing time-consuming and error-prone. To solve this challenge, the team leveraged the Sequence usage API to automatically stream transaction data into Sequence. Usage events are ingested in real-time and correctly attributed based on each customer's unique pricing terms, automatically generating accurate usage-based invoices for hundreds of customers.

A magically simple UI and dedicated support for a quick implementation

Faced with the challenge of onboarding hundreds of customers quickly, the typical six-month implementation period often seen with traditional billing solutions wouldn’t suffice. With the support of a dedicated solutions engineer and priority onboarding support, Bridge successfully activated all of their customers, linking their invoicing to QuickBooks, and integrating payments with Stripe in under 40 days. This automated workflow has saved Bridge’s finance team hours on monthly billing runs, and ensured that they can scale to thousands of customers without requiring additional headcount, or running the risk of invoicing mistakes at scale.

Get in touch to book a Sequence demo.

Sequence Customers

Other companies using Sequence

See how forward-thinking companies use Sequence to reach their business goals.

See all customer stories