Error reduction

Reduce revenue slippage to <2% through accurate invoicing for bespoke contracts1 FTE

1 billing operator running revenue collection for 100+ customersConsolidated stack

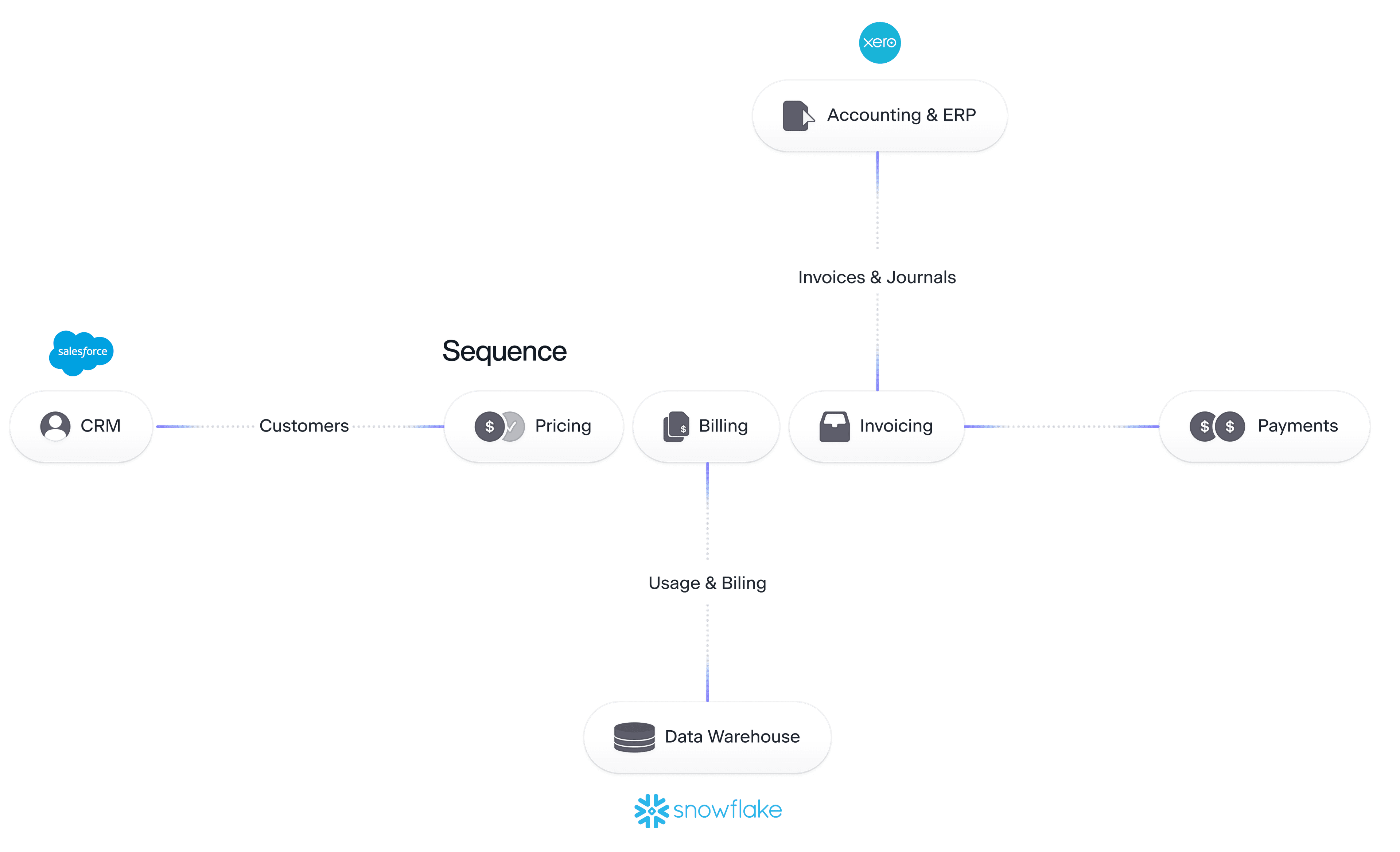

One platform covering quote to cash from Salesforce to XeroSchedule your demo and get started in hours.

We spent 6 months evaluating the entire billing sphere, and Sequence was the most intuitive quote-to-cash platform for FinTechs that we’ve come across. With more than 100 custom contracts, we were fully live within weeks of providing our data to Sequence

Pierre-Edouard Jumel, CFO @ Primer

Primer provides unified infrastructure for global payments and commerce. With unrivaled freedom and visibility across the payments and commerce ecosystem, Primer equips global brands with the tools to effortlessly optimize performance, build at pace, and capture untapped revenue to accelerate growth. Primer has raised a total of $73M from investors including Accel, Balderton, Iconiq and Tencent.

Primer selected Sequence to scale the quote-to-revenue process for their fast-growing customer base of bespoke, usage-based deal terms.

Primer set out to establish a scalable revenue collection infrastructure that could support their next phase of growth. Their spreadsheet <> Xero based approach had worked up to this point, but there were telling signs that this would not scale in line with the customer growth that Primer is experiencing. With that, the Primer team, led by CFO, Pierre-Edouard Jumel, set out to evaluate all of the quote to revenue solutions out there.

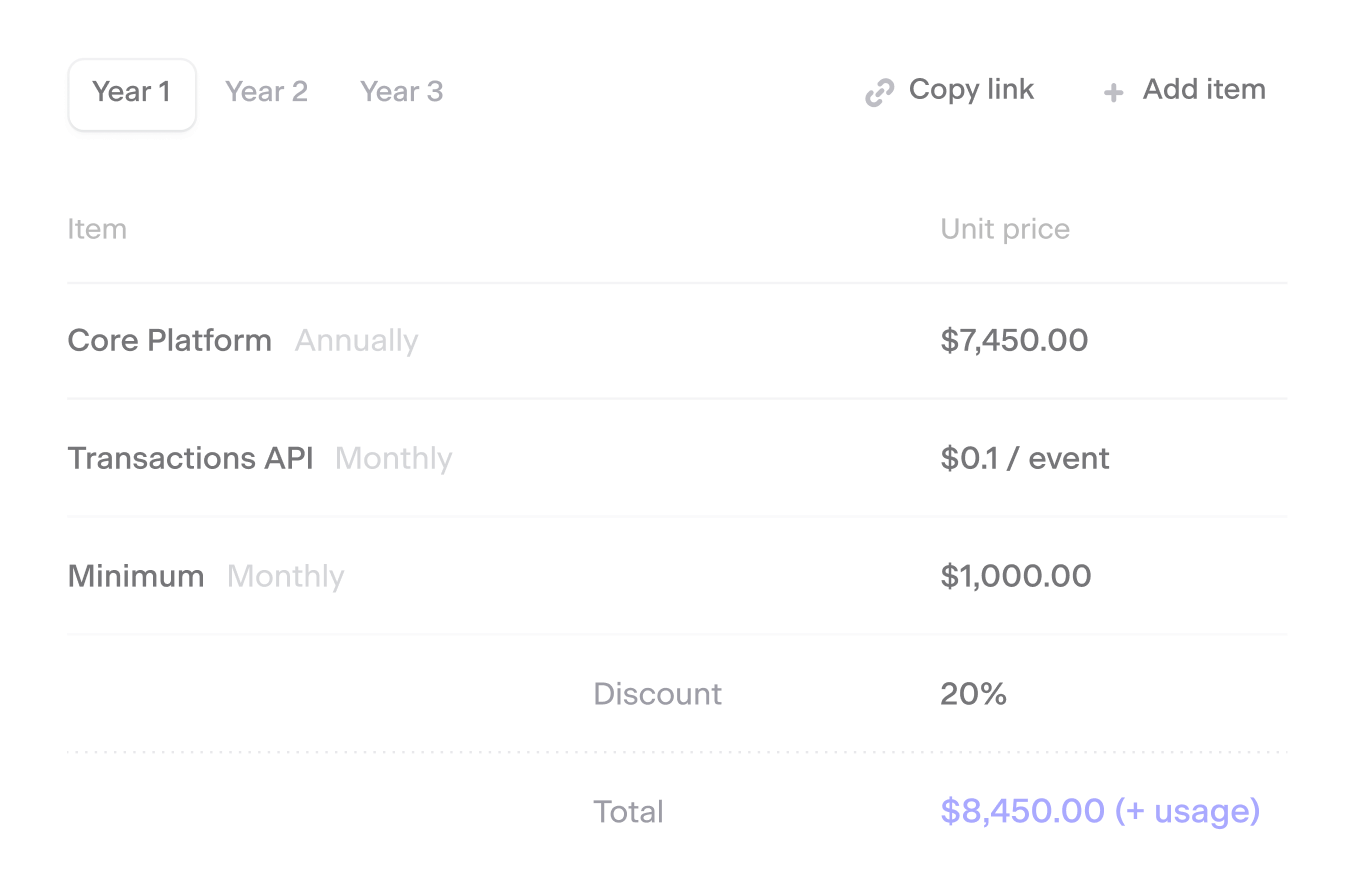

Following a comprehensive evaluation process of all major billing players, Sequence was selected by the Primer team based on the pricing flexibility which could cover all bespoke contracts across the business, whilst providing an operator-friendly UI that could be managed by one finance operator without any ongoing engineering support.

The Challenge

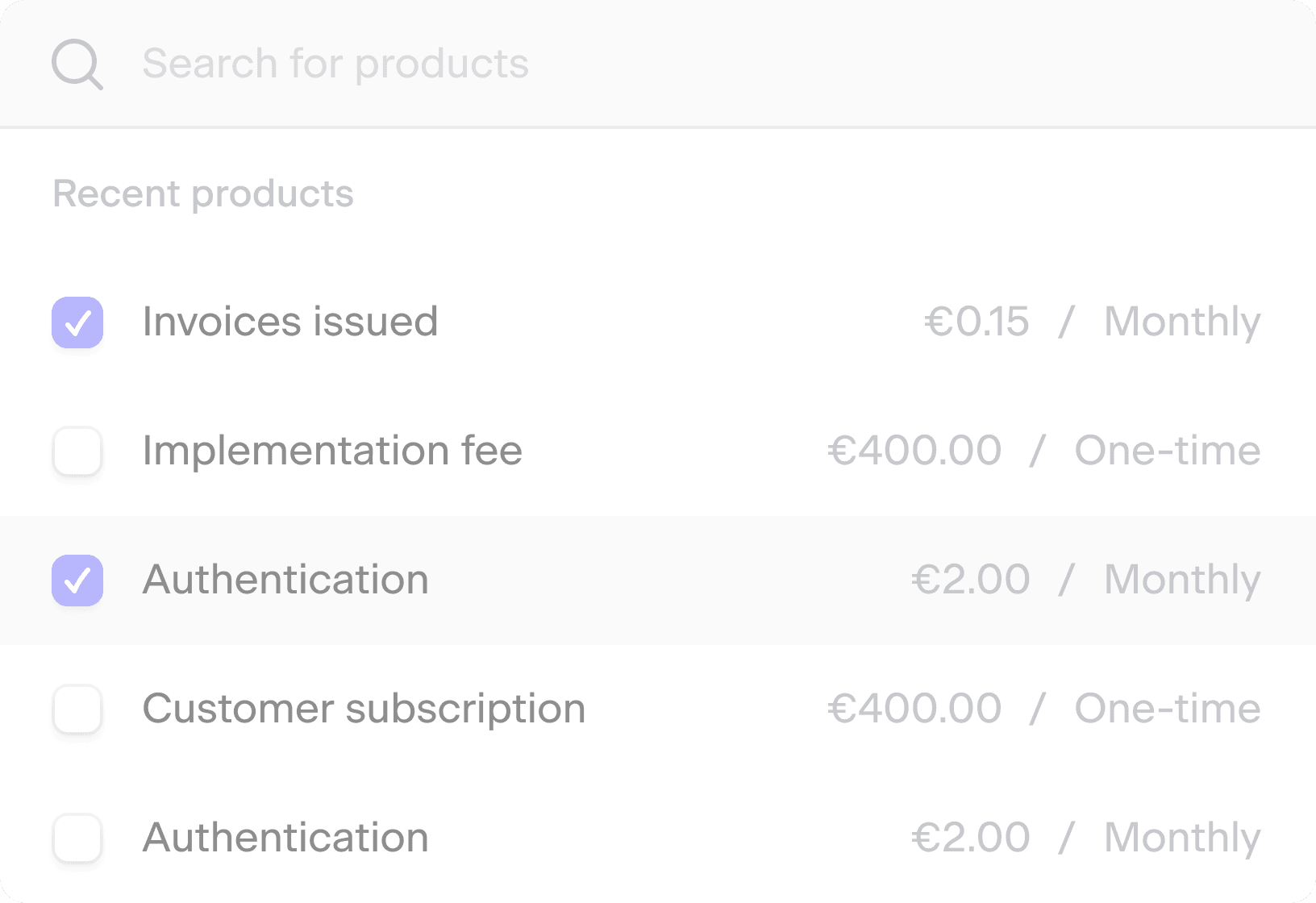

Primer sought an efficient quote-to-cash solution to handle their growing customer base which could manage their complex, custom pricing scenarios while fitting seamlessly within their existing stack (Salesforce, Snowflake and Xero). The Primer team aimed to find a platform that was purpose-built for custom deal terms and transaction-based pricing, while providing an intuitive UI that could be managed autonomously by their finance team, without ongoing engineering involvement.

Tailoring to complex, dynamic pricing models

As a sales-led fintech, Primer has a large degree of variation in the contracts across their customer base, which has created a huge operational burden for finance to accurately invoice each of these customers every month. Primer’s previous process revolved around a data export from Snowflake, which then had to be imported to the master billing spreadsheet which is where the magic happened. The usage file had to be matched with the corresponding deal terms and usage rate agreed with each customer. This meant that screenshots of pricing snippets and hard coded cells were often relied upon as the basis for high value monthly invoices. A process most usage based companies with bespoke pricing know all too well. Primer’s pricing flexibility was a key factor in winning many recent deals, so it was important that this was retained when they decided to begin an extensive evaluation of all quote-to-cash players in the market.

Preventing revenue loss and correcting billing inaccuracies

Primer negotiated detailed contracts across their mid-market and enterprise clients, which often featured complicated usage agreements and bespoke pricing / discount terms. The reliance on manual calculation methods in spreadsheets was starting to result in billing mistakes and revenue discrepancies, which was the catalyst behind the search for a more scalable revenue collection platform which could address these issues without necessitating vital engineering resources.

Quick deployment and limited resources

Facing fast-paced growth, Primer.io needed a system that could be quickly implemented to match their expanding operational needs. With the absence of a specialised Finance team dedicated to billing, it was vital for the chosen solution to be user-friendly and require minimal setup time.

The Solution

Unparalleled pricing optionality

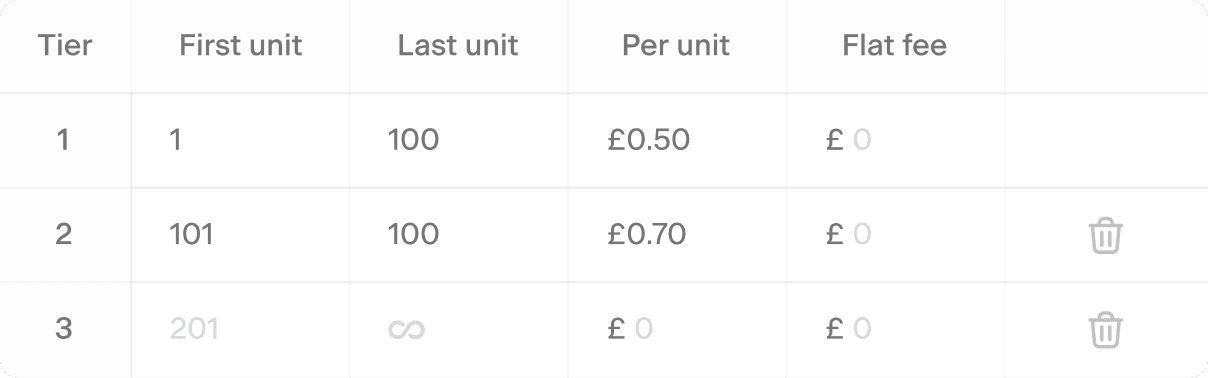

Primer leveraged the volume-based pricing models offered by Sequence to create tiered pricing structures which encourage increased use of the Primer product suite. Like many usage-based companies, Primer also deploys minimum fees across these products, which provide increased revenue certainty for usage-based customers. Additionally, Primer was able to leverage the flat fees available on all Sequence usage-based pricing models, which allows companies to charge a $ fee, regardless of the level of usage that customers rack up each month.

Ensuring all usage is accurately converted into customer invoices

Due to the combination of high usage event volume, coupled with the custom detail terms, Primer were focused on generating accurate, aesthetic invoices to provide a positive billing experience for their active customers. By using the draft invoice states in Sequence, Primer were able to establish an approval workflow where the usage data fed in by Snowflake would automatically trigger the invoice creation at the end of each month, providing the finance team with a simple review process of checking the final invoice amounts, before finalising and issuing the invoices which are then fully synced and reconciled in Xero.

Launching beyond capacity constraints

With 1 dedicated finance operator focused on billing, Primer did not have the appetite or bandwidth for a complex, multi-quarter rollout. With the support of the Sequence team, dedicated Implementation Manager, Software Engineering DRI and shared slack channel with clear SLAs, Primer received white glove support from the moment they signed with Sequence, and were able to go-live within weeks of providing their usage data to the Sequence team.

Get in touch to book a Sequence demo.

Tech Stack Overview

Sequence Customers

Other companies using Sequence

See how forward-thinking companies use Sequence to reach their business goals.

See all customer stories