1 FTE

One finance operator billing 150+ customers20+

Billing currencies handled by Sequence75%

Time saving managing billing runs (8h to 2h per month)Schedule your demo and get started in hours.

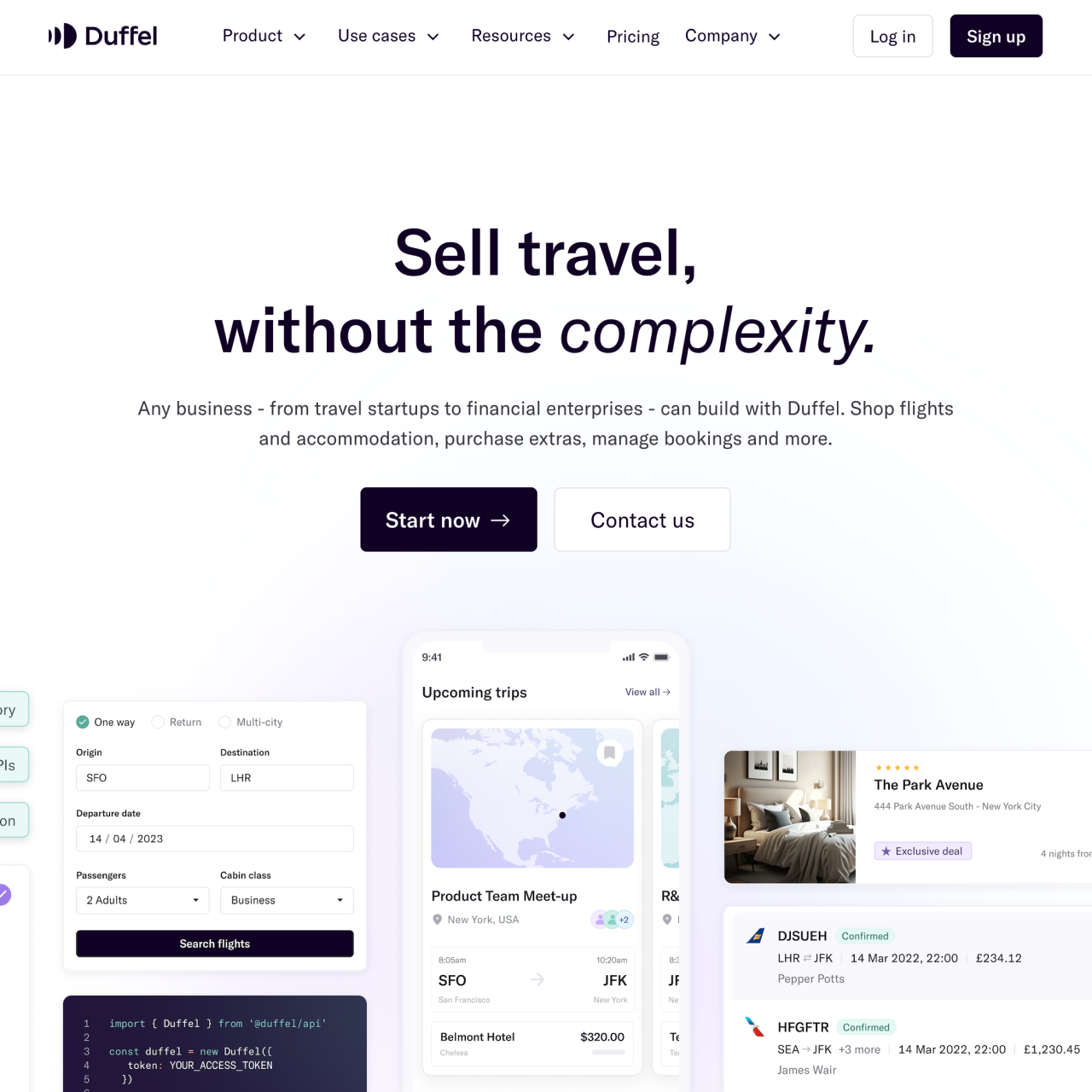

At Duffel, we are trying out multiple different sets of pricing strategies at the same time, which has made billing automation a ruddy nightmare in the past...

Mark, Product Manager at Duffel

Duffel enables businesses to integrate travel services into their offerings including the ability to shop for flights and accommodation, purchase extras, and manage bookings. Duffel's product suite includes tools for flight search and booking, earning commissions on property stays, and a customizable flight-shopping experience called Duffel Links. Duffel has raised a total of $56.2M in capital and is backed by leading investors such as Index Ventures, Benchmark Capital and Blossom Capital.

Sequence provides flexible billing and usage metering infrastructure to power Duffel’s next phase of growth

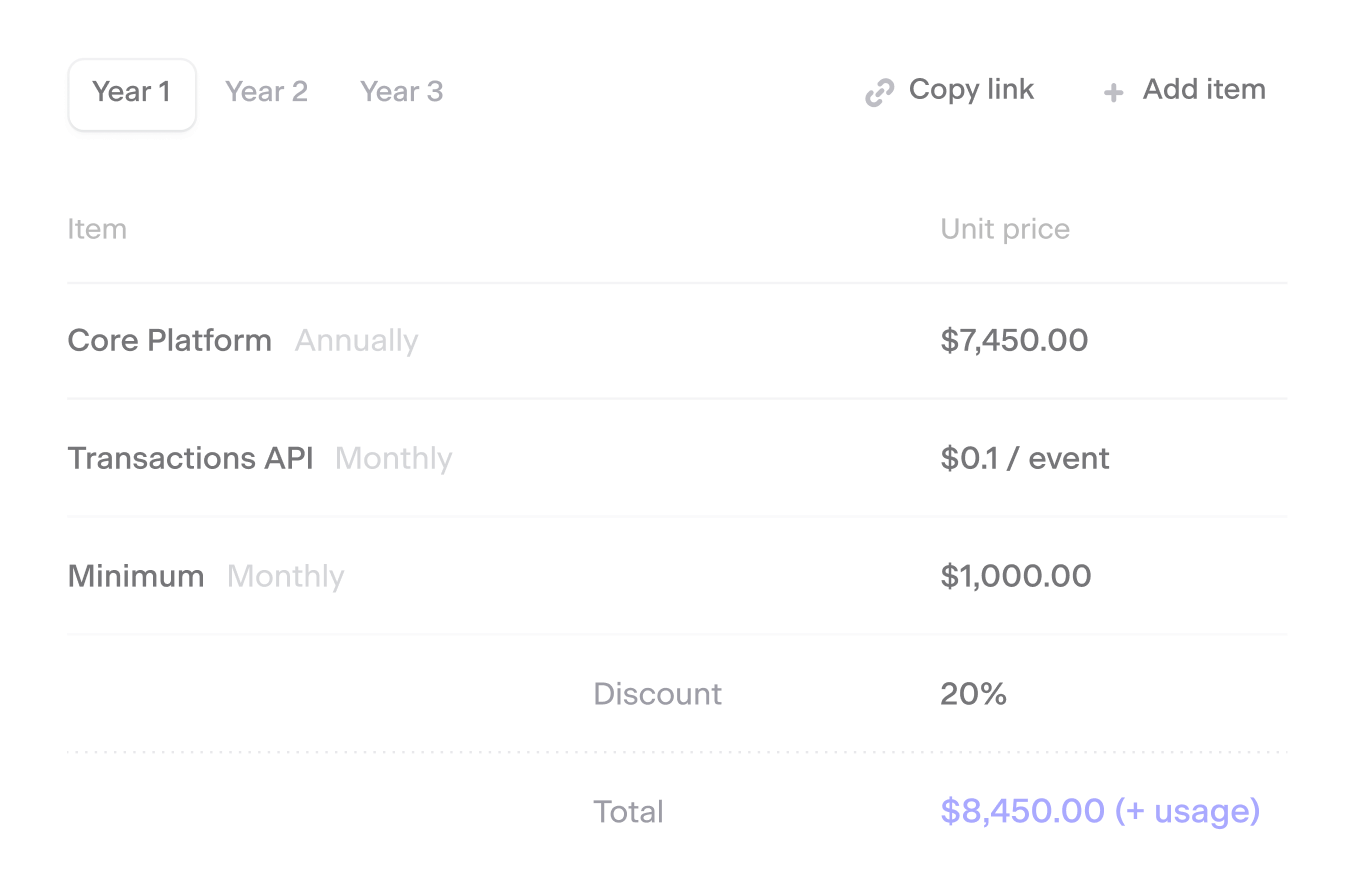

Duffel partnered with Sequence to automate quote to revenue workflows from the CRM (Salesforce) to the ERP (Netsuite), and everything in between. Sequence provides Duffel with a powerful billing engine for high volume API usage calculations and infrastructure to handle multi-currency billing for a global customer base. Crucially, with Sequence, Duffel can continue to experiment on pricing as business grows, without creating manual work for the Finance team.

Duffel needed a way to streamline billing workflows without compromising the ability to experiment with new pricing models. Three challenges contributed to Duffel’s decision to adopt Sequence for their quote to revenue stack.

The Challenge

Aggregating data and billing for multiple usage-based pricing models

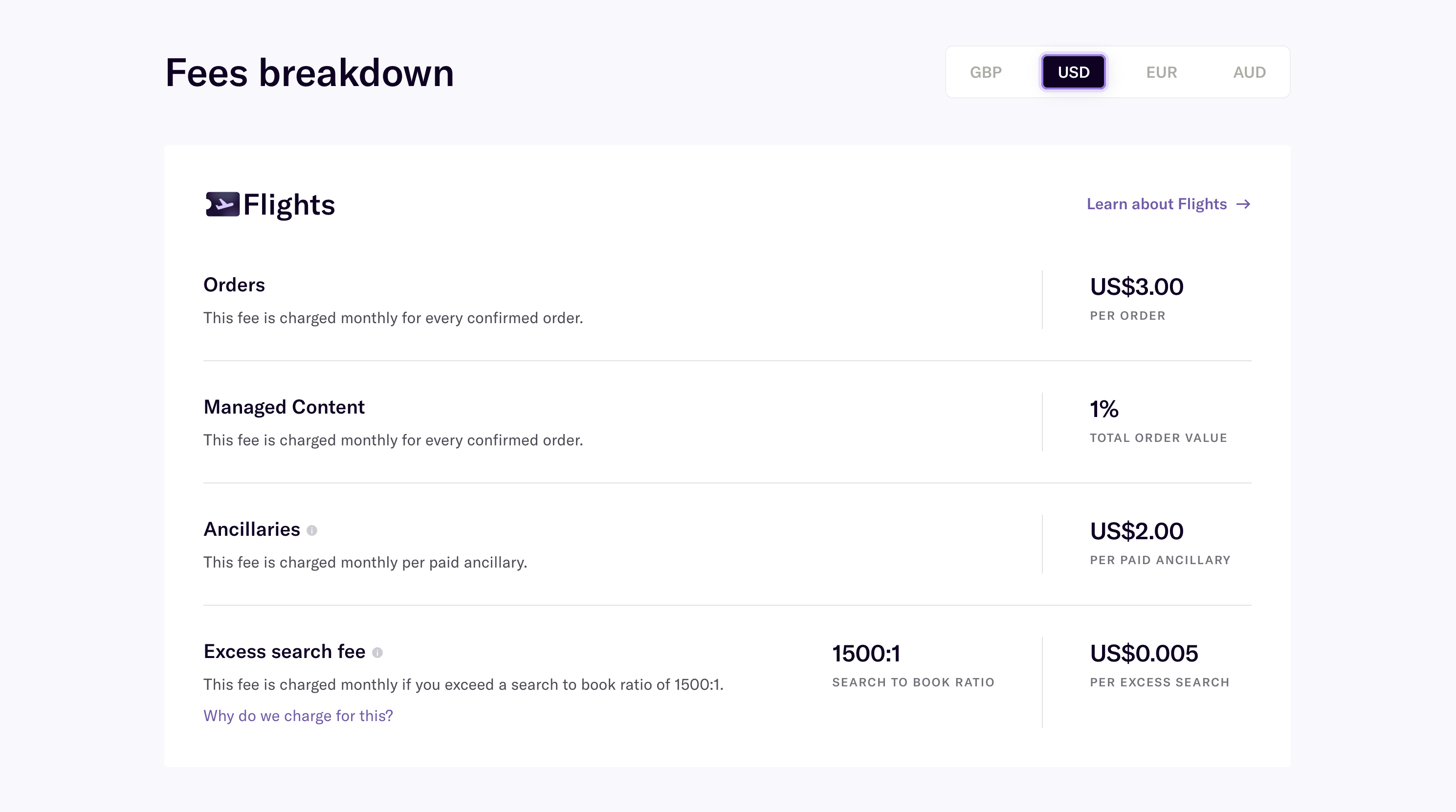

Duffel’s pricing includes several ways that API customers can be charged, such as the number of booked orders, percentage fees of transaction volume, and the number of excess searches via Duffel. Fees vary between fixed and tiered unit fees, platform fees and minimum commitments. Fees vary between fixed and tiered unit fees, platform fees and minimum commitments. Duffel’s specific commercial terms and rates can vary between customers, which results in manual billing workflows and spreadsheets to keep track of pricing and billed amounts.

Handling a broad range of transaction and billing currencies

As an API provider for worldwide travel services, dealing with many currencies is a given. Since one customer can transact in a range of currencies, Duffel need to aggregate and convert transacted amounts for all customers, making sure each customer is billed in the right currency. Duffel want to avoid having to store currency logic in their systems, and were looking for a billing provider who could handle this.

The flexibility to experiment with other pricing models

Pricing is never finished. Duffel need the flexibility to experiment with new pricing models without creating manual work for their Finance team. Duffel are increasingly embedding their API into third-party platform providers, resulting in complex parent-child account hierarchies the Finance team must grapple with during each monthly billing process.

“We are trying out multiple different sets of pricing strategies at the same time, which makes billing automation a ruddy nightmare.” (Mark, Product Manager)

The Solution

Usage metrics to power real-time event ingestion and billing

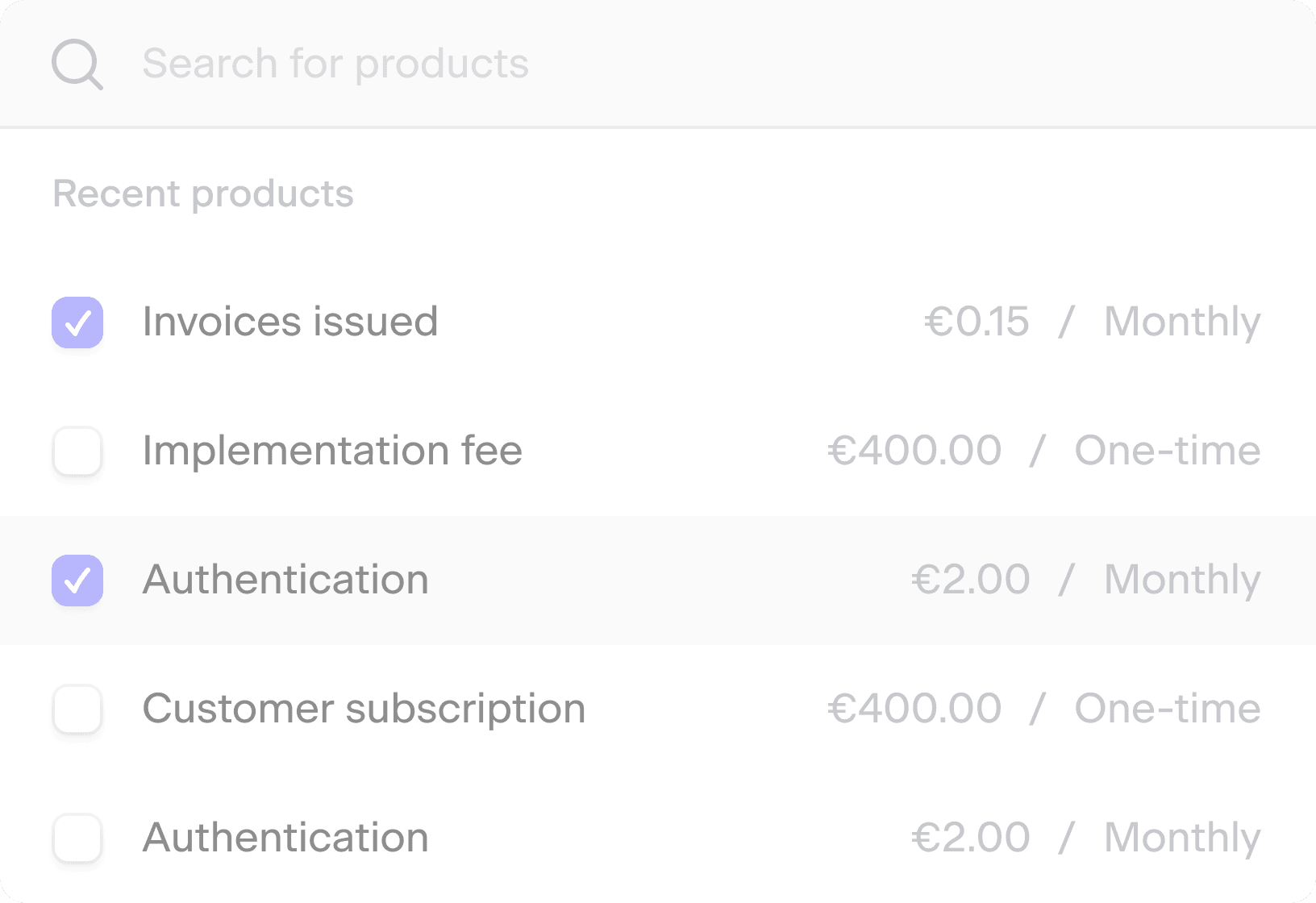

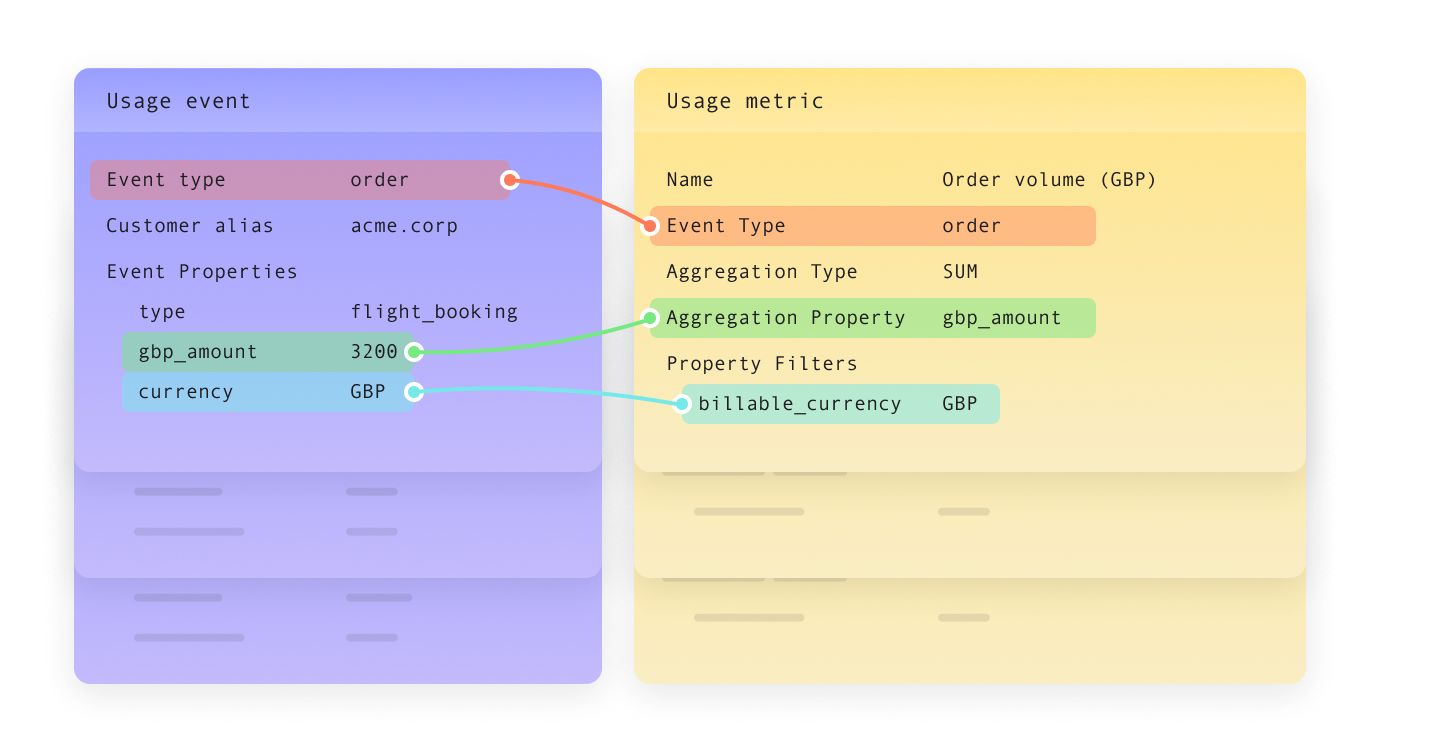

With Sequence, Duffel can quickly set up multiple metrics to aggregate booking order quantities and transaction volumes with flexible event filters:

- Count of orders via API, filtered by currency

- Sum of transaction volumes, filtered by currency

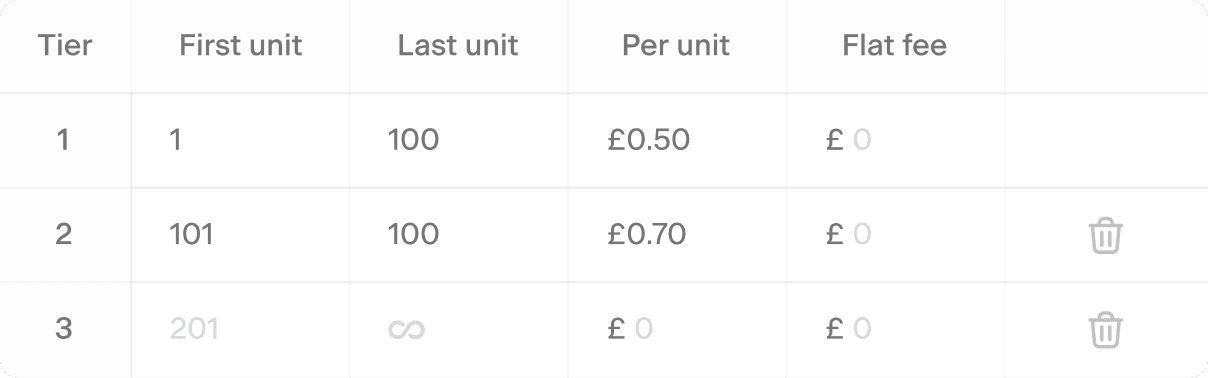

Duffel then leverage these usage metrics to choose between the following pricing models in Sequence:

- Linear pricing: fixed cost per unit (API call)

- Volume pricing: tiered costs for each tier of units (API calls)

Using the flexible usage infrastructure behind Sequence, Duffel can quickly define their usage metrics and immediately automate their monthly usage calculations. Customer invoicing is powered by a real-time feed of usage events into Sequence. Some pre-aggregated data is also sent on a monthly basis. With Sequence’s robust event and metric design, it is easy for Duffel to experiment and launch new pricing models whenever they need.

Automated multi-currency billing

Duffel use Sequence to automatically manage the transaction and billing currencies of their customers.

- When a transaction occurs, Duffel run a standard calculation converting the amounts into multiple billable currencies (e.g. USD, EUR, GBP) and sends this to Sequence.

- Sequence then aggregates the amounts accordingly based on the pricing and metric applicable for each individual customer.

This means Duffel can be agnostic to the billable currency of a customer, and only need to do a spot conversion when submitting the event.

Parent-child account structures with platform reseller customers

With Sequence, Duffel can easily break down usage reports and invoiced amounts per child account on every invoice. Duffel are also able to automate advanced parent-child billing calculations including rolling up tiered pricing to parent accounts.

Sequence Customers

Other companies using Sequence

See how forward-thinking companies use Sequence to reach their business goals.

See all customer stories