2 days saved

By automating billing calculations and invoicing each month2x customers

Handling a doubled customer base without needing additional headcountAccurate invoices synced to Xero

One platform for accurate usage-based invoices, all synced to XeroSchedule your demo and get started in hours.

Using Sequence over the past year has revolutionized our ability to scale revenue collection. We haven’t needed to make any finance hires, have reduced revenue leakage meaningfully, and I’m spending less time than ever on monthly billing runs despite the fact that we’ve doubled our customer base since implementation.

Justin Sebok, VP Operations & Product

With backing from top VCs like Firstminute Capital and United Ventures & led by a team of operators from companies like Mastercard, HSBC, and Deliveroo, Volume is setting the standard for transparency in online transactions.

Volume has grown with Sequence since 2023 and over the past 1.5 years, has created an automated billing and invoicing workflow that supports their scaling customer base with usage-based contracts.

Volume’s previous process required:

- Manual invoice creation by pulling usage data, and separately calculating totals per custom contract, which was time consuming and prone to missed revenue and billing errors

- Invoices and journal entries to be managed from scratch within Xero at the end of each month with no automation

Given their rapid growth, Volume knew they needed an all-in-one billing, invoicing, and reporting solution to scale their revenue collection process over multiple years.

To scale efficiently, Volume is leveraging our:

- Scalable platform for billing and invoicing that would seamlessly connect to Xero, eliminating the need to manually link individual invoices to journal entries

- Highly flexible billing engine that scales with the business and reduces revenue leakage from manual usage-based calculations

- An intuitive dashboard that helps reduce DSO by showing invoice status in real-time and allows for automated dunning

The Challenge

Building a scalable contract to cash workflow

Given their recent growth velocity and limited team resources, Volume needed to build a scalable accounts receivable process without requiring additional headcount for invoice creation and revenue collection.

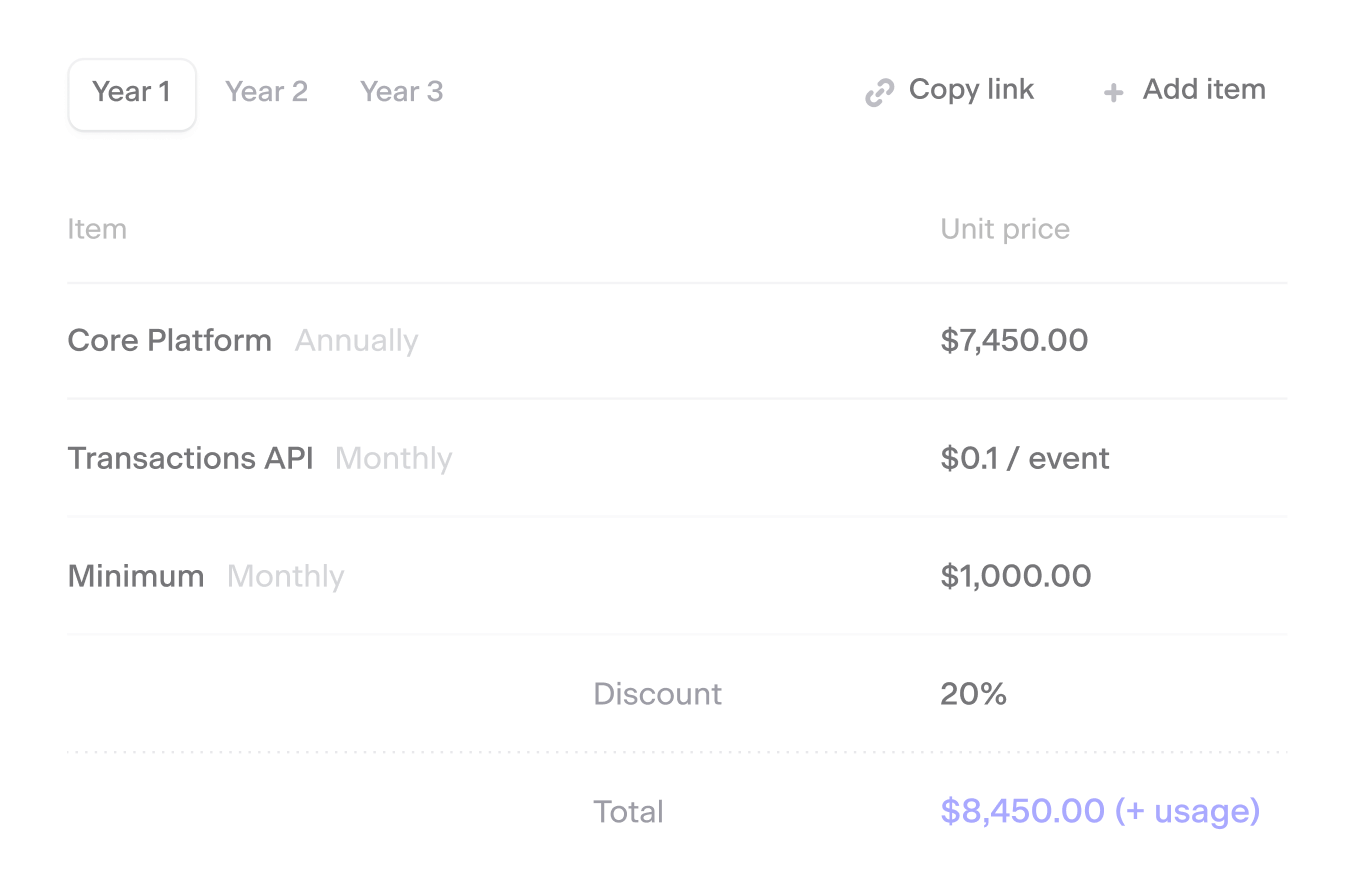

Generating accurate invoices for Volume’s complex, usage-based contracts

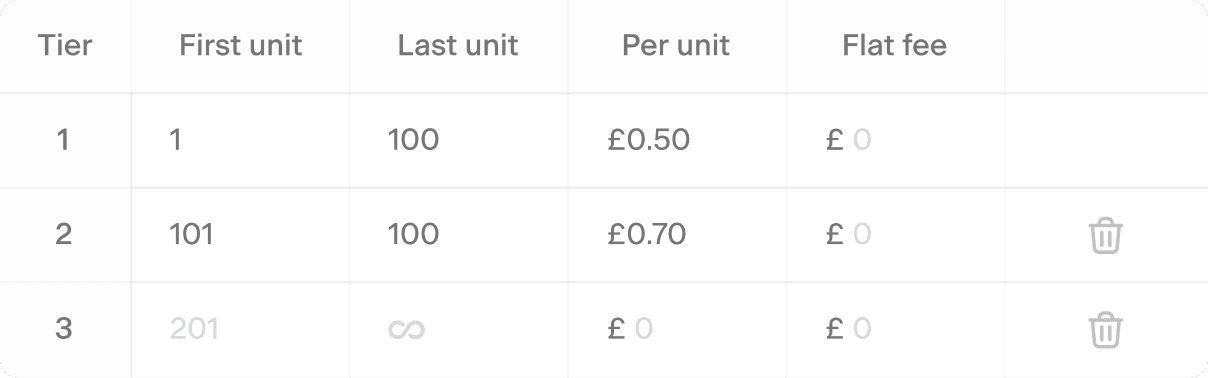

Volume’s pricing includes a variety of usage-based products with flat fees, minimums, discounts and fee caps, making manual invoice creation time consuming and error prone. This meant their billing platform needed to be able to automate invoice calculation for multiple usage based pricing models.

Automated invoice tracking and seamless integrations with accounting systems of record

Volume’s leadership team previously had limited visibility into monthly invoices due to their data being scattered across a data warehouse and spreadsheets. Additionally, due to a lack of updated invoice payment statuses in Xero, invoices could go uncollected for months. They needed a solution that could ingest their usage data, use it for invoice generation, and seamlessly connect with Xero to reduce potential revenue leakage and eliminate the need for manual reconciliation.

“It was difficult to manage billing because I had to manually calculate each invoice based on usage data and the terms the sales team agreed to. We also had no clear view of invoice status, leading to some never being collected at all. Our billing solution had to be able to handle the process from beginning to end, so I could trust the information was correct and all revenue was collected.” - Justin Sebok, VP Operations & Product

The Solution

A billing engine for any pricing model

Volume’s sales team is now empowered to sign deals with custom terms because they know they can correctly bill on them each month. By easily configuring complex pricing terms in Sequence and automating usage ingestion / calculations, Volume no longer has to spend hours combing through usage data to create invoices and eliminates the risk of manual error.

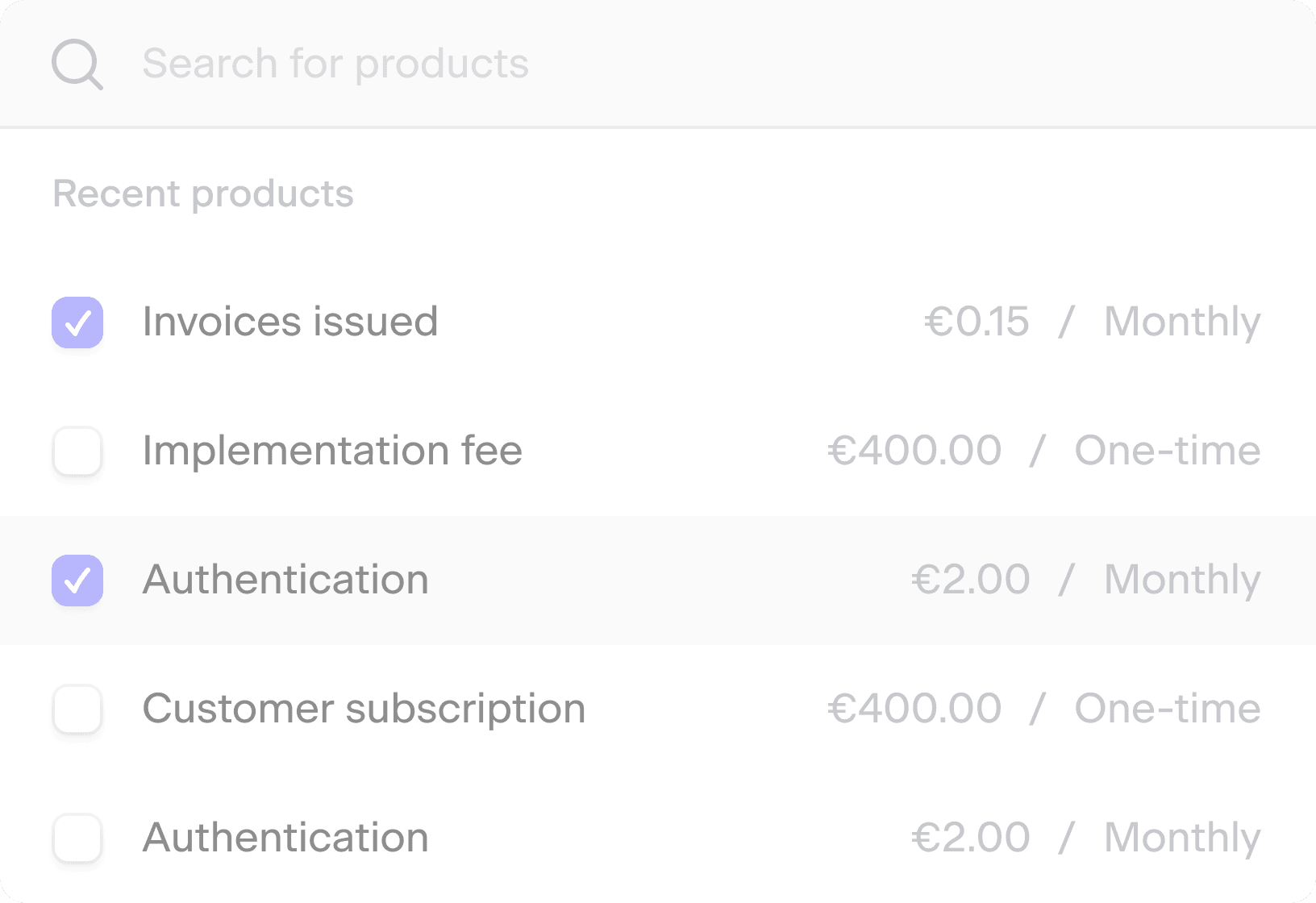

Visibility on invoice calculations and overdue payments

Sequence offers the flexibility needed for Volume to use any usage-based pricing model or custom terms when closing deals, which allows them to generate invoices accurately according to their contract terms and track payments seamlessly in the dashboard. Additionally, their customers have a clear view of their invoices and usage data on the Sequence customer dashboard, boosting their trust that Volume is billing them correctly.

Scaling revenue collection beyond headcount limitations and budget constraints

Sequence automated Volume’s end-to-end billing and invoicing workflow, reducing their time spent on monthly billing runs and freeing up their operations team’s time from manual invoice creation. This has allowed Volume to double their customer base and maintain an accurate invoicing process without needing to grow their team since implementing Sequence.

Get in touch to book a Sequence demo.

Sequence Customers

Other companies using Sequence

See how forward-thinking companies use Sequence to reach their business goals.

See all customer stories