1 unified platform

Quoting, billing and revenue recognition in a single platform15%

Reduced revenue leakage by automating billing for custom contracts8 days

Reduced deal cycle time by 8 daysSchedule your demo and get started in hours.

It’s incredibly hard to find a platform that can drive success for multiple teams at once. Sequence has transformed the quoting, billing and revenue workflows for our sales, RevOps and finance teams. Sequence enables us to easily configure new pricing proposals that have driven higher deal win rates, and our finance team loves that we can automate the revenue collection and recognition process from the moment new deals are signed. We were skeptical that a modern platform could take on so much heavy lifting, but Sequence has been remarkable. We’re now able to double our customer base without any additional ops headcount.

Andrew Maddox, COO

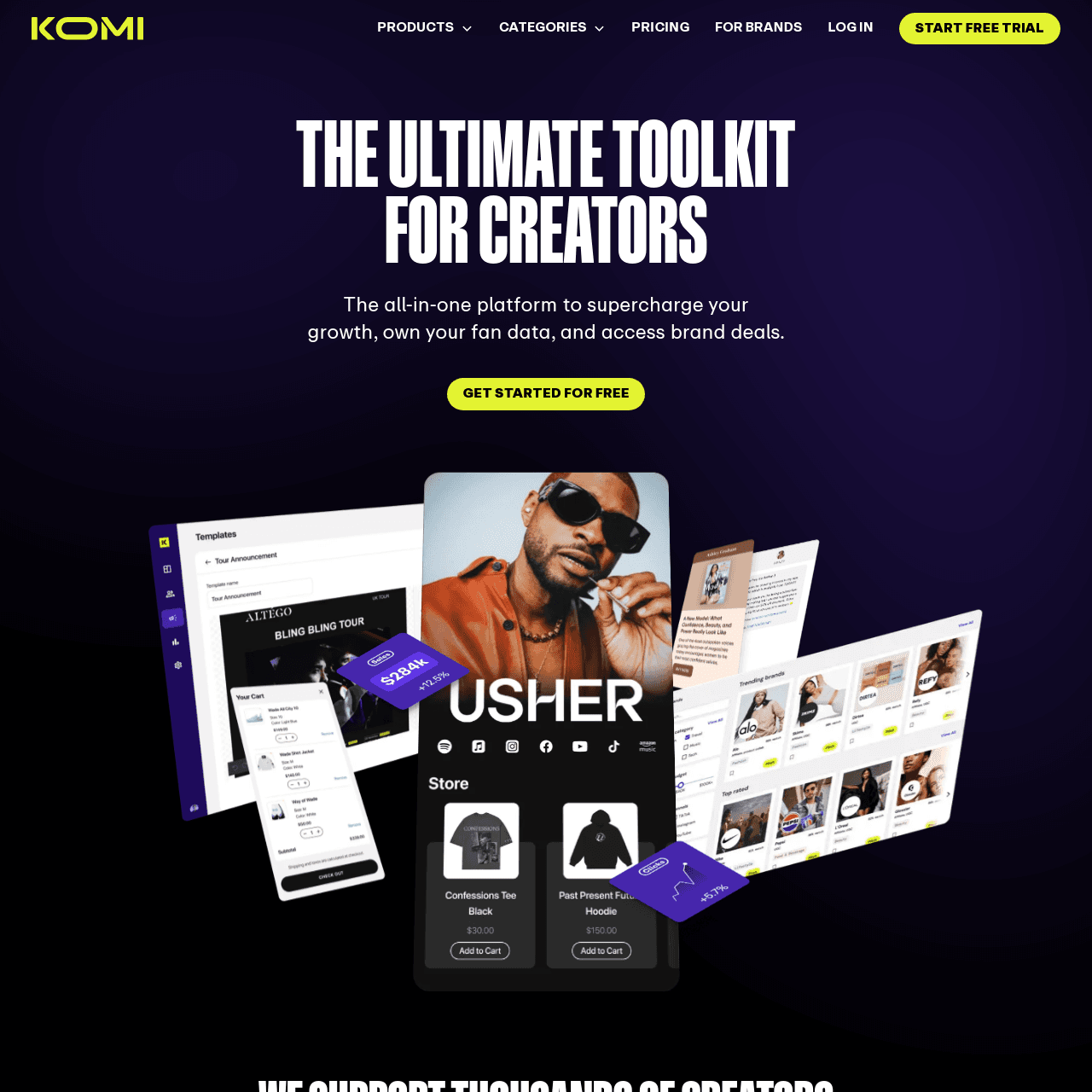

Komi provides a single, customizable destination for creators, artists, and brands to consolidate their online presence, showcase content, sell products or tickets, and engage with fans. Komi streamlines multiple links, social channels, and offerings into one easy-to-navigate hub, simplifying audience interactions and monetization efforts.

Komi chose Sequence to support their quoting, e-signature, billing and invoicing workflows.

Komi’s previous process required:

- Google slides were used to create pricing proposals, with limited flexibility to model custom contract terms in an elegant manner.

- Signed contracts were handed from Sales to Finance once the deal was won, often resulting in invoicing errors due to challenges interpreting custom deal terms

- Invoices and journal entries needed to be managed from scratch within Xero at the end of each month, with minimal automation or customization

With customer volumes quickly increasing, Komi realized the need to install a more robust quote to cash workflow that could enable their commercial teams to win deals quickly, while ensuring that revenue could be easily collected by finance downstream.

They set three key criteria for the migration, which led them to choose Sequence:

- 1 scalable, flexible platform for quoting (CPQ), billing, invoicing and revenue recognition

- Highly flexible billing engine that could reduce revenue leakage for custom contracts at scale

- A quoting module that would eliminate translation errors between sales and finance when invoicing for custom contracts

The Challenge

Streamlining quoting, billing, and invoicing workflows

With a fast growing customer base, and limited resources, Komi needed to scale their quote to cash workflows in a way that could satisfy sales, RevOps and finance teams without procuring and integrating multiple point solutions across CPQ (quoting), billing, revenue recognition and reporting.

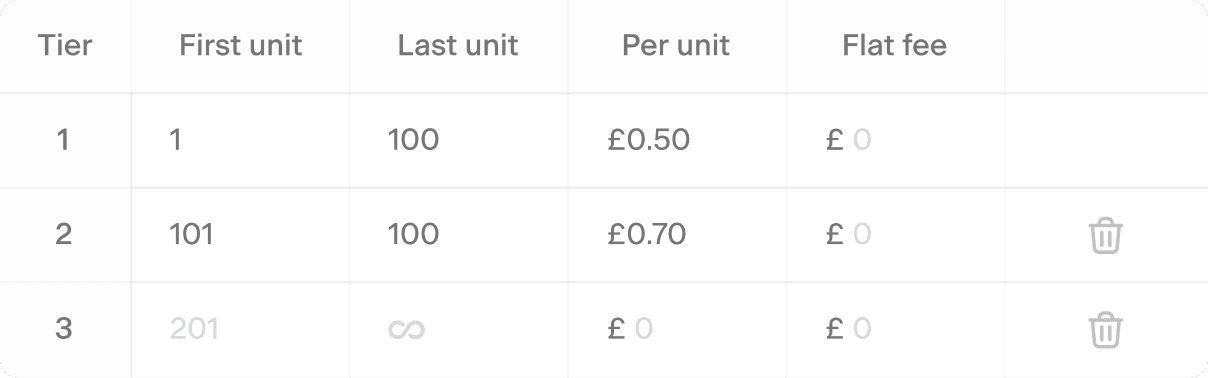

Reducing revenue leakage for custom contracts

Komi has a wide range of pricing agreements across their creator network, which requires them to be flexible in their commercial terms. With very strong customer relationships in place, removing invoicing mistakes was essential to the Komi team. This meant that their chosen billing system had to provide the agility to support these bespoke deal terms at scale.

A flexible quoting process that will reduce deal times, while keeping sales happy

The challenge with most CPQ systems is that there is a lack of flexibility for sales reps to configure bespoke deal terms, which are often needed to win deals. This slows down deal times, and reduces conversion rates. Komi were focused on finding a quoting workflow that would provide aesthetic, flexible order forms, while ensuring that their sales team could drive faster deal times and produce even higher conversion rates across all reps.

The Solution

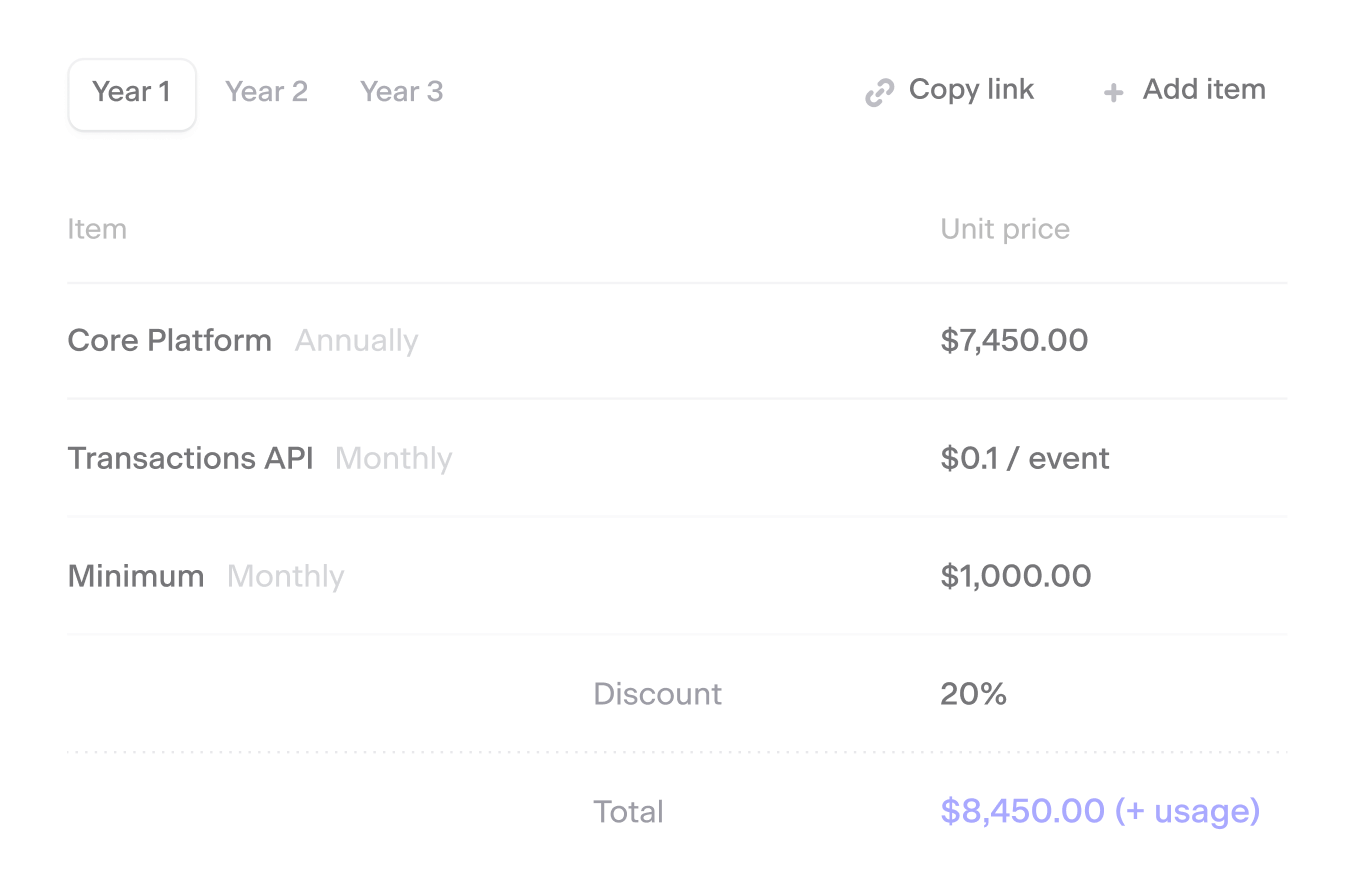

One flexible, scalable platform for quoting (CPQ), billing and invoicing

Sequence initially slotted in as a billing solution for Komi’s newly closed deals. After seeing the UI, setup speed and ease of use, Komi quickly layered on the Sequence CPQ module to build their entire quote to cash workflow from HubSpot to Xero. The Komi sales team now sends multiple quotes from Sequence each week and can then activate billing for that customer once the quote is signed. The Komi finance team then benefits from automated invoicing, revenue recognition, collections (via Stripe) and dunning workflows.

Accurate, automated invoicing for any custom contract

The multiple usage-based pricing models available on Sequence allowed Komi to accurately model and invoice for their in-advance consumption model, which was key to ensuring a flawless end-customer billing experience. On top of that, the Sequence customer portal allows Komi customers to obtain a clean source of truth on all usage + invoicing activity, including a summary view of all outstanding payments.

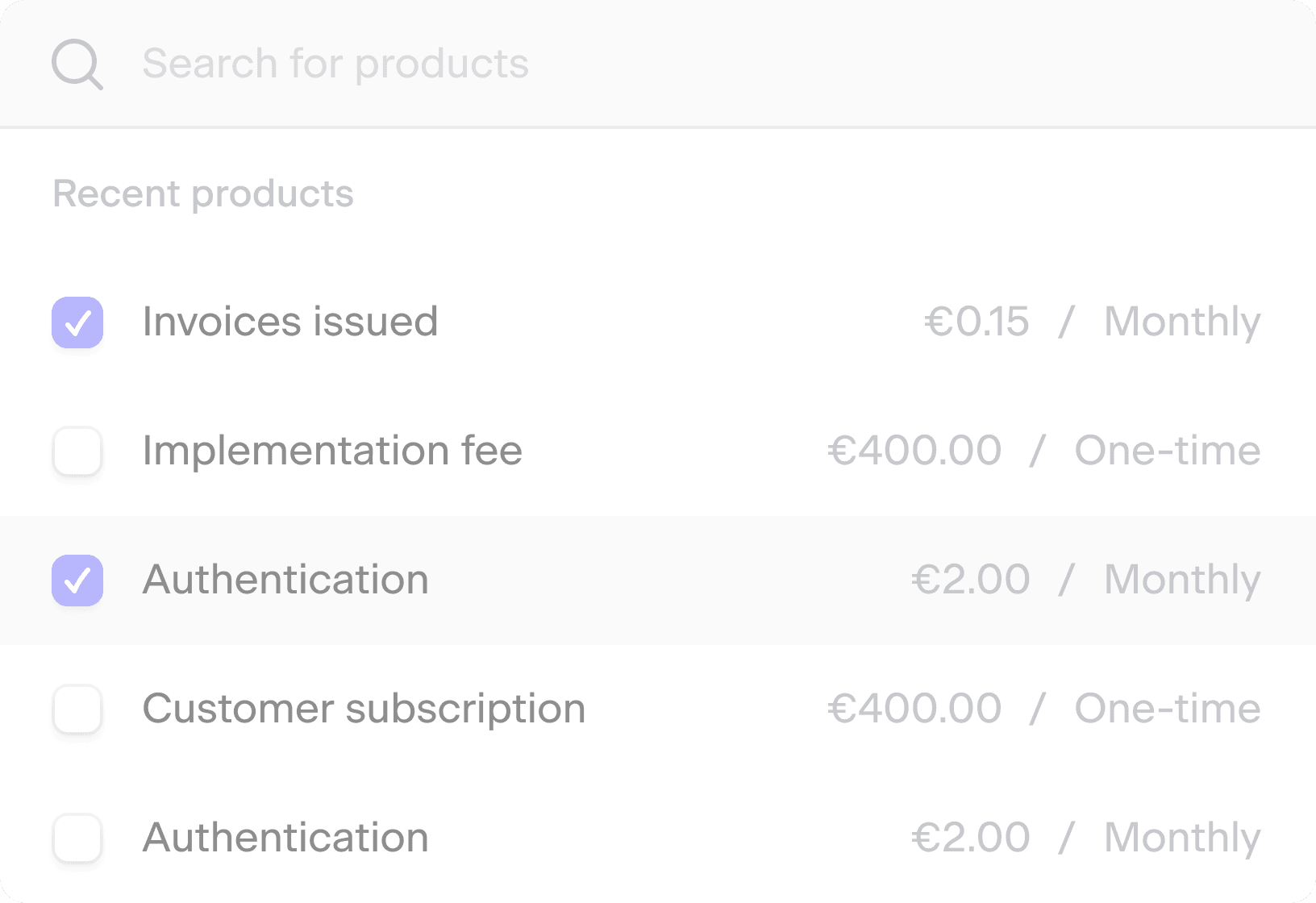

A ‘lovable’ quoting workflow for Sales, that reduces deal times and increases conversion rates

Komi is leveraging the Sequence quoting module, using personalized templates to quickly configure a pricing proposal for customers. The Sequence quoting UI acts like a notion page, so the Komi team now has a CPQ platform that is very nice to use, while providing the toolkit needed to win deals with aesthetic order forms that can be quickly signed and executed.

Get in touch to book a Sequence demo.

Sequence Customers

Other companies using Sequence

See how forward-thinking companies use Sequence to reach their business goals.

See all customer stories